Why in news?

The ‘Report of the Working Group on Digital Lending including Lending through Online Platforms and Mobile Apps’ has been released by the RBI.

What is digital lending?

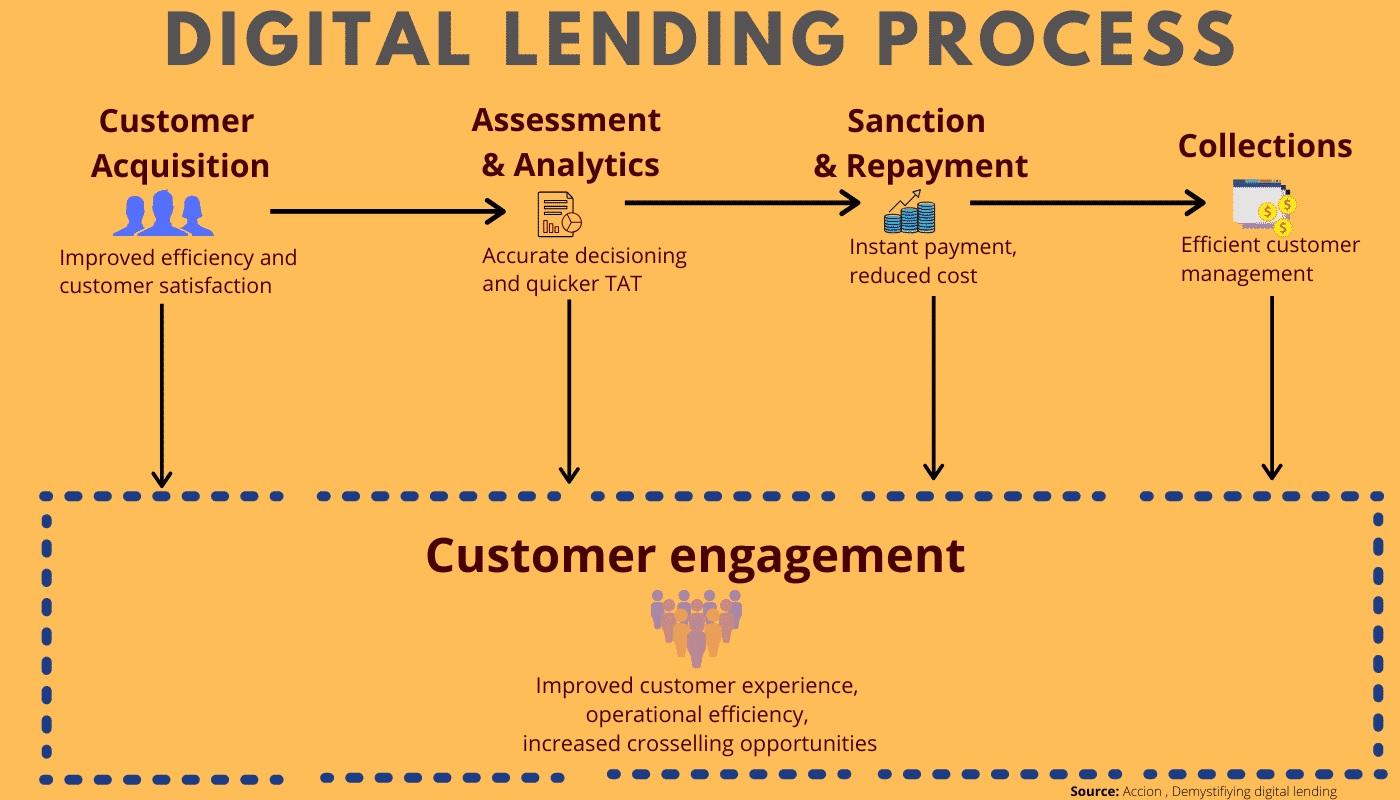

- Digital lending is the process of availing credit online

- Digital lending is mostly preferred by those who are generally not able to avail any credit through the formal sources of finance like banks.

What digital lending models have been in place?

- Presently, there are three digital-lending models seen through the regulatory-approach lens.

- Bank/NBFC-owned digital platforms – They operate under the direct regulatory purview of RBI.

- Fintech companies’ proprietary digital platforms - They work in partnership with banks/NBFCs, typically under an outsourcing arrangement to support sourcing of borrowers, assess creditworthiness using alternative data and recover the dues.

- Being mere intermediaries, these platforms are not required to seek any registration with RBI and are only indirectly regulated through RBI’s outsourcing guidelines applicable to Banks/NBFCs.

- Peer-to-peer (P2P) lending platforms - They usually involve the otherwise unregulated retail lenders.

- RBI has mandated such platforms to seek registration as NBFC-P2P and thus they are directly regulated by RBI.

What is the significance of digital lending?

- Instant disbursal of funds

- Customer friendly application

- Paperless process

- Transparent and simplified process

- Reasonable interest rates

- Ensure swift payback

- Reduced credit gap

- Operating cost effieciency

- Financial inclusion – Example- JAM (Jan Dhan-Aadhaar-Mobile) trinity

What are the concerns of digital lending?

- Unauthorised lenders

- Exorbitant rates of interest

- Use of coercive repayment methods

- Non consensual collection of user data

RBI report finds 600 illegal loan apps operating in India which are available on several app stores for Android users.

What are the key recommendations on digital lending?

- The working group was set up on January 13, 2021 with Jayant Kumar Dash, Executive Director of RBI as the Chairman.

- Loan servicing - The balance-sheet lending through the apps should be restricted to RBI-regulated entities.

- All loan servicing should be executed directly in a bank account of the balance-sheet lender and disbursements should always be made into the bank account of the borrower.

- Nodal agencies - Nodal agencies must be set up to run digital lending applications through stringent verification processes .

- Legislative measures - The group has recommended that in the medium term, the government may consider bringing in legislation to prevent illegal lending activities by introducing the ‘Banning of Unregulated Lending Activities Act’.

- Technology standards - Certain baseline technology standards should be developed when it comes to digital lending apps and compliance with those standards as a pre-condition.

- Algorithmic features used in digital lending has to be documented to ensure transparency.

- The group recommends that auditable logs should be kept for every action that a user performs on the app and that every fintech app must be signed/ verified in a secured manner.

- Data collection and usage - Data should be collected from the borrower with prior information on the purpose, usage and implication of such data and with the explicit consent.

- All such data must be stored in servers located in India.

- Reporting of lending activities - Lending by regulated entities (REs) through lending apps must be reported to credit bureaus.

- And only regulated entities can access bureau data for the purpose of collecting or reporting data on behalf of borrowers.

- Interest calculation - Interest must be calculated on the basis of the actual number of days and no prepayment penal rate of interest for short-term consumer credit.

- Shaping the Self- Regulatory Organisations (SRO)- Standardised code of conduct for recovery to be framed by the proposed SRO in consultation with RBI.

- The group recommended the maintenance of a ‘negative list’ of Lending Service Providers by the proposed SRO.

What does the draft rule imply?

- The panel wants to encourage more legitimate lenders while enhancing customer protection and making the digital lending ecosystem safe and innovative.

- The digital lending market in India is evolving fast, and with the Fourth Industrial Revolution it is a matter of time for a shift from digital-too to digital-first to digital-only.

- It is now up to digital apps to play by the rules and self-regulate themselves.

- As the universe of fintech grows, RBI must arm itself with the necessary technology and technical expertise needed to track lending apps on a real-time basis.