What is the issue?

The development of Bitcoin and other cryptocurrencies in a little over a decade has spawned a parallel universe of alternative financial services. Here is a look at them.

What do crypto businesses offer?

- Generally, lending and borrowing.

- Earn interest on holdings of digital currencies, often a lot more than on cash deposits in a bank.

- Borrow with crypto as collateral to back a loan. Crypto loans generally involve no credit checks as transactions are backed by digital assets.

- E.g., In a BlockFi interest account, depositors can earn a yield 100 times higher than on average bank accounts.

- [BlockFi is a secured non-bank lender that offers cryptoasset-backed loans to cryptoasset owners.]

Benefits

- Fosters financial inclusion.

- Unusually high return on their holdings for consumers.

- Provide financial stability for customers in countries with volatile government-issued currencies.

Why such high yields?

- Crypto outfits pool deposits to offer loans and give interest to depositors, just as traditional banks.

- But by law, banks are required to have minimum reserves as a safety backup.

- Unlike this, crypto banks do not have the reserve requirements; the institutions they lend to can take risky bets.

- E.g., BlockFilends to hedge funds and other institutional investors who exploit flaws in crypto markets to make fast money without actually holding risky assets.

- Other risks: Cyberattacks, extreme market conditions, or other operational or technical difficulties that could lead to a temporary or permanent halt on withdrawals or transfers.

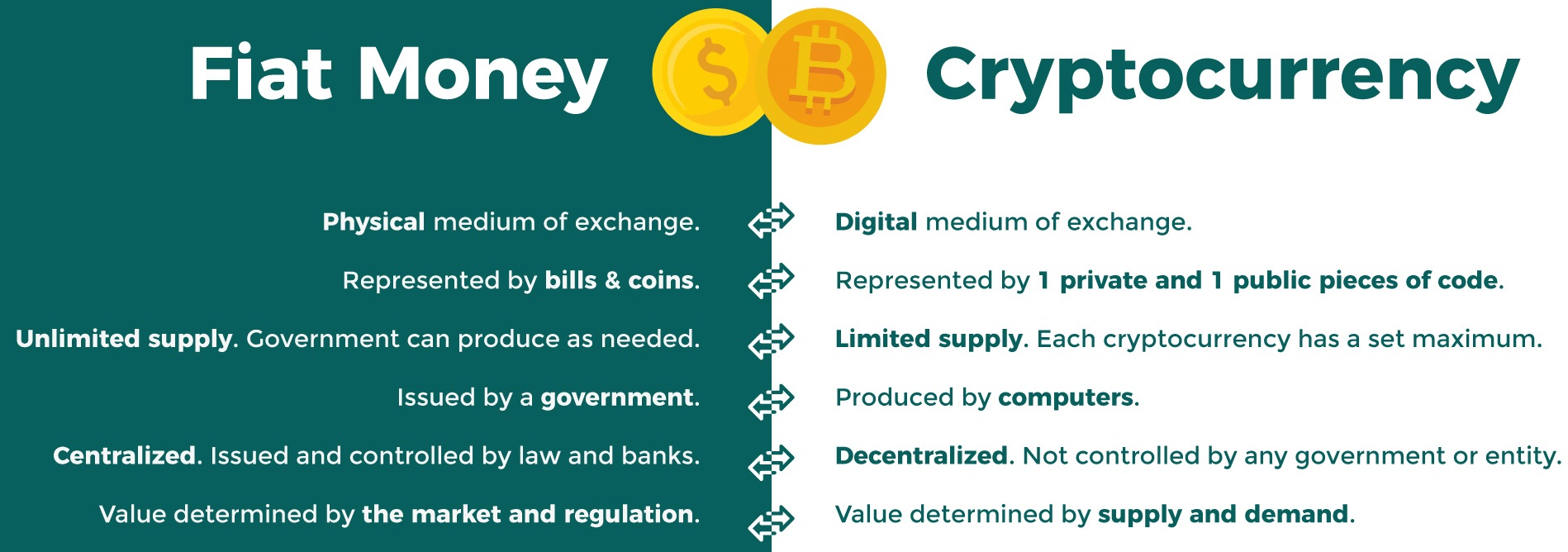

What is a stablecoin?

- Crypto is very volatile, making it less practical for transactions like payments or loans.

- But Stablecoins are cryptocurrencies linked to stable assets, commonly the dollar. Popular dollar-tied tokens include Tether and USD Coin.

- It aims to do in digital form what government money does.

- They provide the steady value of government-issued money in digital form for blockchain transactions, but they are issued by private entities.

Risks

- Stablecoin issuers hold and monitor reserves, just as central bankers manage supply and demand.

- But there is no guarantee they actually hold the one-to-one dollar backing they claim.

- So, a sudden surge in withdrawals could lead to a collapse in one of those assets, putting clients and the broader economy at risk.

- Also, a central bank digital currency would render stablecoins irrelevant.

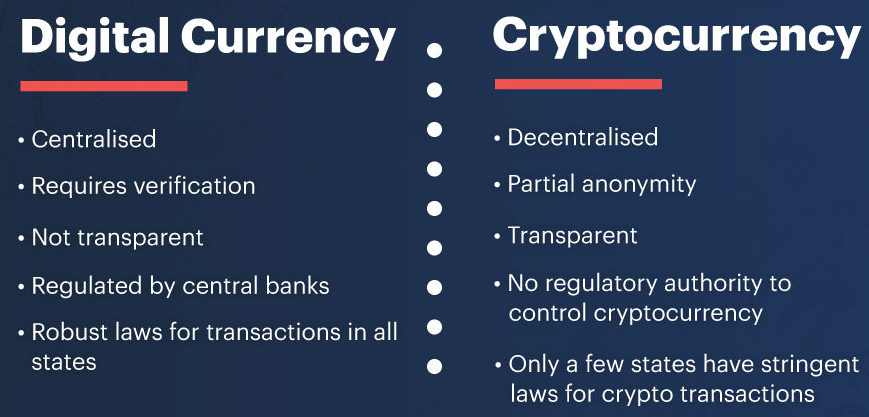

What is a central bank digital currency?

- Central bankers are examining the potential for issuance of a government-issued cryptocurrency.

- That would offer the convenience of crypto with the reliability of money controlled by a central bank.

- But governments catching up to the innovations in the market for years will be a challenge.

What is DeFi?

- Decentralized finance, or DeFi, refers to an alternative finance ecosystem where consumers transfer, trade, borrow and lend cryptocurrency.

- Financial products become available on a public decentralized blockchain network, independently of traditional financial institutions and the regulatory structures.

- DeFi aims to “disintermediate” finance, using computer code to eliminate the need for trust and middlemen from transactions.

- It’s a computer-controlled market that automatically executes transactions.

- In contrast, centralized finance, or CeFi, businesses more closely resemble traditional finance, or TradFi.

- Here, consumers enter into an agreement with a company like BlockFi that collects information about them, requires them to turn over their crypto and also serves as a central point for regulators.

What could be done in the future?

- A new regulating approach for adapting to the new technology demands.

- E.g., Requirements like code audits and risk parameters, instead of mandating that DeFi protocols maintain the reserves of a bank and collect customer information.

- Using artificial intelligence and data analysis to monitor suspicious activity and tracking identity to fight financial fraud.

Source: The Indian Express